You can book a 1:1 remote session with us to discuss your migration.

When considering employment in Australia, understanding the wage structure is essential for making informed financial decisions. Australian wages are composed of several elements that together form your overall compensation package. This guide will help you navigate the concepts of base salary, superannuation, and how wages are expressed for both permanent and contractual jobs.

The base salary is the core component of your wage, representing the fixed amount you are paid before any additional benefits or bonuses. In Australia, base salary is typically expressed as an annual amount for permanent employees, though it can also be shown as a monthly or hourly rate depending on the job type. This figure does not include superannuation or other benefits.

Superannuation is a crucial part of the Australian wage system, designed to help employees save for retirement. Employers are legally required to contribute a percentage of your base salary (currently 11.5% as of 01/07/2024) to your superannuation fund. These contributions are in addition to your base salary and are a significant part of your overall compensation package.

Salary Scarifice for Superannuation

In addition to base salary and superannuation, Australian workers may receive various other benefits, such as bonuses, allowances for travel or housing, and paid leave entitlements. The availability and type of these benefits often depend on whether the job is permanent or contractual.

For permanent employees, wages are typically structured as an annual salary that includes both the base salary and superannuation contributions. Payments are usually made weekly, bi-weekly, or monthly, depending on the employer's payroll schedule. Permanent roles also often include additional benefits such as paid leave (annual, sick, and long service leave), bonuses, and other allowances, making these positions attractive for those seeking stability and comprehensive benefits.

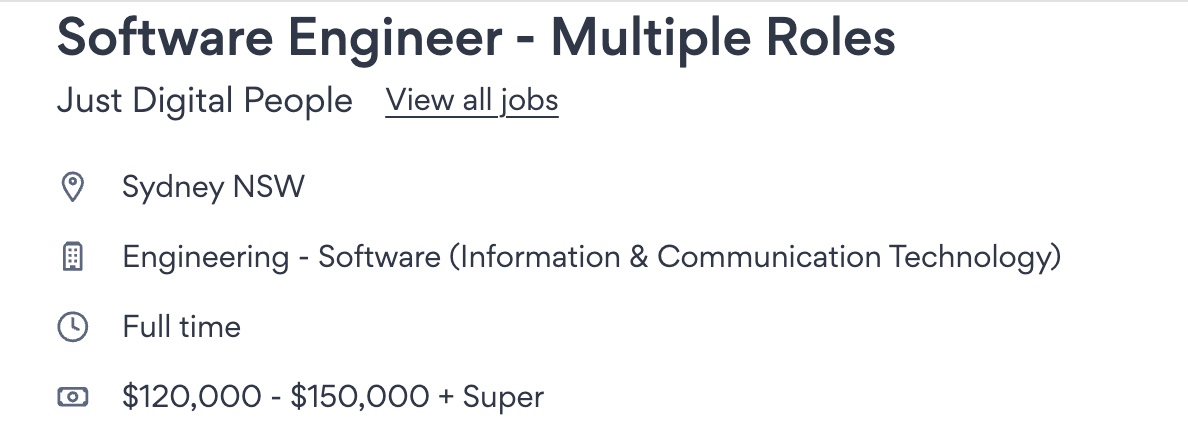

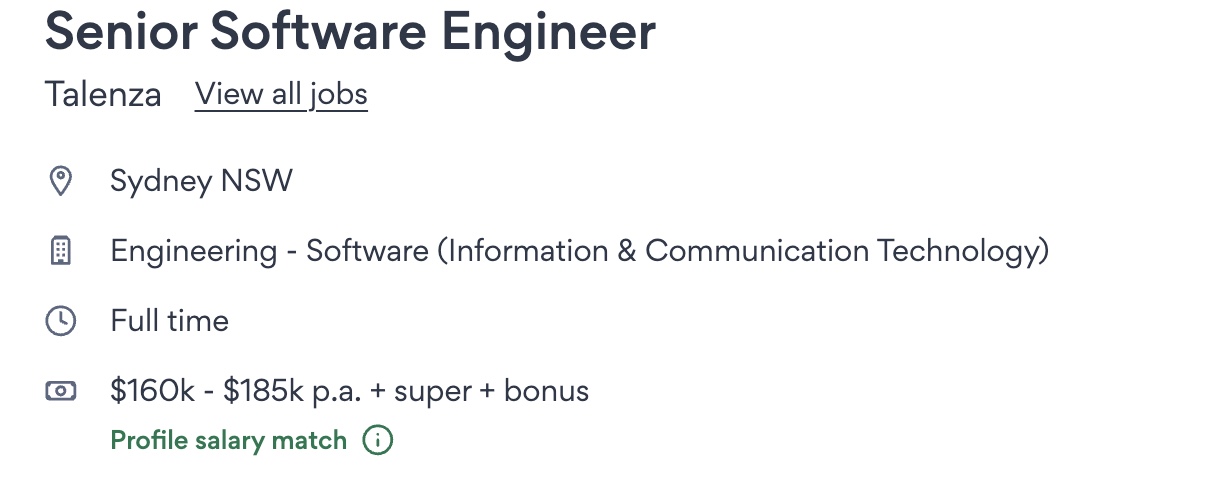

|

|

|

|

|

Contractual jobs in Australia can vary widely in how wages are structured. For fixed-term contracts, wages might be expressed as an annual salary similar to permanent positions, but for casual and freelance roles, wages are typically based on an hourly rate or project-based fee. While superannuation contributions are still required for most contractors, the rate and structure might differ, especially for those working freelance or under casual contracts.

Casual and freelance workers often do not receive the same benefits as permanent employees, such as paid leave or job security. However, they might be compensated with higher hourly rates to account for these differences. Negotiating the terms of your contract, including pay rates and benefits, is crucial in these roles to ensure you are fairly compensated for your work.

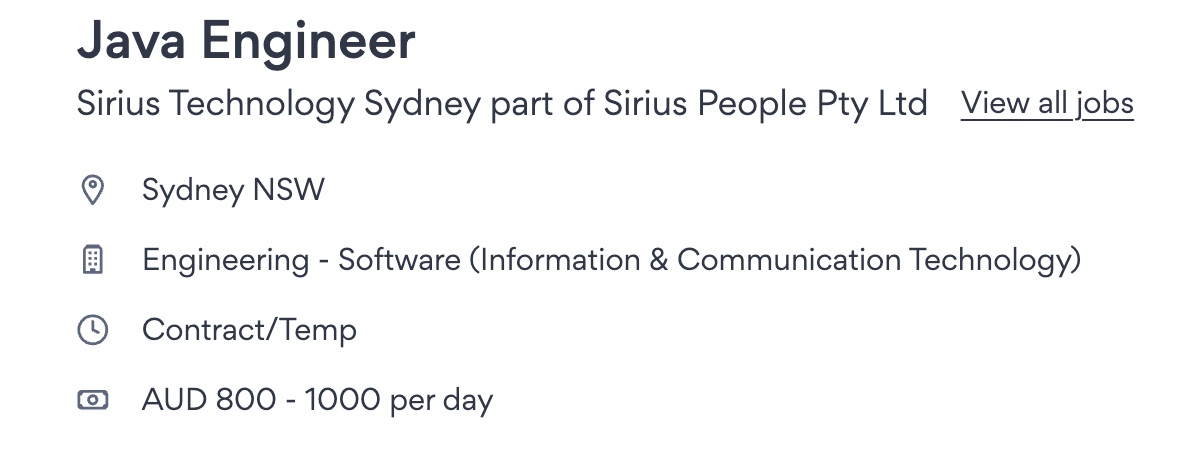

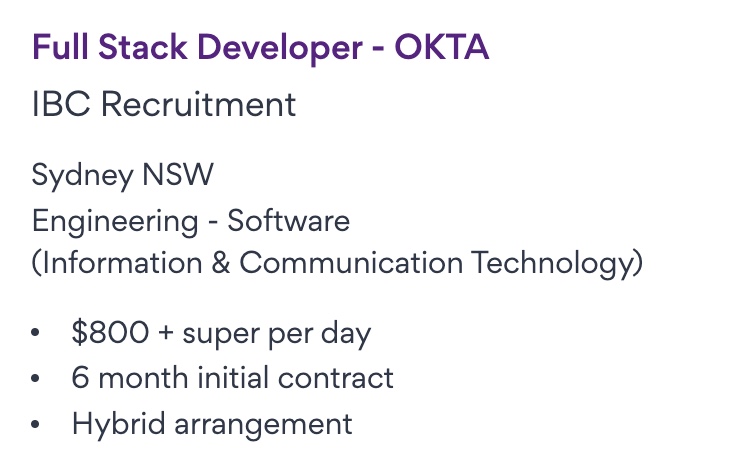

|

|

|

|

|

Australia has a progressive income tax system, where the amount of tax you pay increases with your income. Employers typically deduct income tax from your wages before you receive your payment, meaning the amount you take home is your net pay. Other possible deductions include health insurance premiums, union fees, and contributions to other benefits or savings plans. Understanding these deductions is important to know your true take-home pay.

| Taxable Income | Tax On the Income |

| 0 - $18,200 | Nil |

| $18,201 - $45,000 | 16c for each $1 over $18,200 |

| $45,001 - $135,000 | $4,288 plus 30c for each $1 over $45,000 |

| $135,001 - $190,000 | $31,288 plus 37c for each $1 over $135,000 |

| $190,001 and over | $51,638 plus 45c for each $1 over $190,000 |

You can calculate your inhand salary using the Pay Calculator

You can consult salary benchmarking reports to identify typical salaries for specific roles in industry from various sources